Buying a home is an exciting milestone, but it can also feel overwhelming, especially if it’s your first time. This guide will walk you through each stage of the homebuying process, from setting a budget to moving in, to help you approach this big decision with confidence.

1. Assess Your Finances and Set a Budget

- Evaluate Your Savings: Before you start looking at homes, assess how much you have for a down payment. Most lenders require 3%–20% of the home’s price, though there are options for lower down payments.

- Check Your Credit Score: A good credit score opens up better mortgage rates. Scores above 700 are ideal, but there are options for lower scores as well.

- Get Pre-Approved for a Mortgage: A pre-approval letter shows sellers that you’re serious and gives you a clearer idea of how much home you can afford.

Tip: Factor in additional costs like closing fees, property taxes, and home insurance to avoid surprises later.

2. Decide on Your Must-Haves and Deal-Breakers

- List Your Priorities: Consider the features that matter most, like the number of bedrooms, location, nearby amenities, or outdoor space.

- Be Realistic: Separate “nice-to-have” features from essentials. A flexible mindset helps, especially in competitive markets.

- Explore Neighborhoods: Drive around, visit local shops, and research schools, commute times, and community vibes.

Tip: Think about long-term needs, especially if you plan to live in the home for more than a few years.

3. Work with a Real Estate Agent

- Find the Right Agent: Look for someone experienced in your target area and someone you’re comfortable with. Referrals and online reviews are helpful here.

- Discuss Your Goals: A good agent will listen to your needs and use their expertise to find properties that match.

- Understand Their Role: Agents handle showings, paperwork, negotiations, and can provide insight into fair pricing, but the final decisions are yours.

Tip: Choose an agent who will advocate for your best interests, not just push you toward a sale.

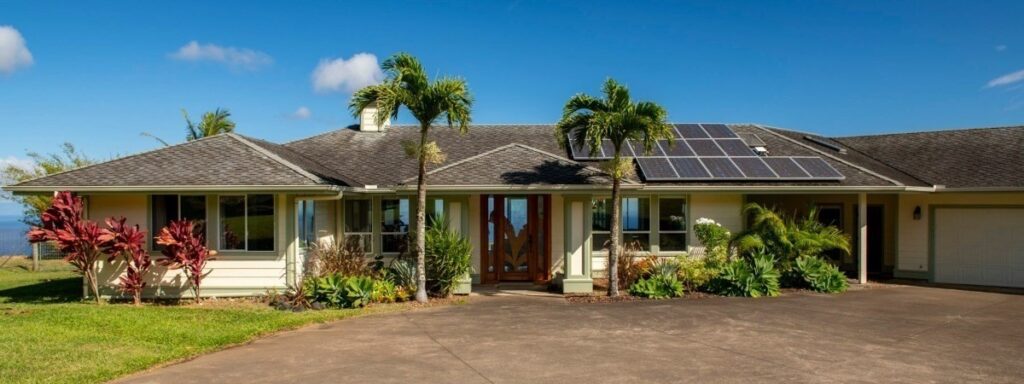

Looking for an agent on the Big Island? Meet our amazing staff!

4. Start the Home Search

- Use Online Platforms: Websites like Zillow, Redfin, and Realtor.com let you view listings, filter for your criteria, and set alerts for new homes in your budget. Your Agent can set you up to receive alerts for properties that match your criteria in the MLS (Multiple Listing Service), which will have the most up-to-date information.

- Visit Open Houses and Showings: This is your chance to see what’s out there and refine your priorities. You’ll also get a feel for how quickly homes are moving in your market.

- Stay Patient: The right home may not appear immediately. It’s worth waiting for something that truly fits your needs and budget.

Tip: Bring a notebook to jot down notes about each property, especially if you’re touring several in a day.

See our great listings! Click here!

5. Make an Offer

- Consult with Your Agent: They’ll help you determine a fair offer based on comparable sales, market conditions, and the home’s condition.

- Negotiate: Sellers may counter your offer, and this is normal. Be prepared to negotiate on price, closing date, or repairs with the help of your Agent.

- Be Flexible: Some sellers may respond faster to offers with fewer contingencies or quicker closing times.

Tip: Keep emotions in check during negotiation—falling in love with a home before the deal is done can cloud your judgment.

6. Get a Home Inspection

- Hire a Professional Inspector: A home inspection will reveal any issues with the property, like foundation problems, electrical issues, or roofing needs.

- Review the Report Carefully: This report can affect your decision to move forward, request repairs, or even walk away.

- Negotiate Repairs or Credits: If issues arise, you can ask the seller to address them or offer credits to reduce the sale price.

Tip: Even if the property looks perfect, an inspection can save you from unexpected repair costs after move-in.

7. Secure Your Financing

- Finalize Your Mortgage: With an accepted offer and a successful inspection, your lender will finalize the loan. Be ready to submit recent financial documents.

- Lock in Your Rate: If mortgage rates are favorable, lock in your rate to protect against future increases.

- Review Closing Costs: These include fees for appraisals, title insurance, and loan processing. Your lender will provide a breakdown.

Tip: Avoid making large purchases, opening new credit accounts, or job changes during this period, as they could affect your loan approval.

8. Close the Deal

- Conduct a Final Walkthrough: Inspect the property one last time to ensure it’s in the agreed-upon condition.

- Sign the Paperwork: Closing involves a lot of signatures. Review everything carefully, and don’t hesitate to ask questions.

- Transfer Funds and Receive Keys: Once the paperwork is signed, funds are transferred, and deed is recorded, the home is officially yours!

Tip: Check that all utilities are set up in your name for the move-in day to avoid any delays.

9. Move In and Make It Your Own

- Plan Your Move: Organize packing, cleaning, and any minor repairs before moving in.

- Change Your Address and Update Accounts: Notify the post office, your bank, and other important contacts of your new address.

- Enjoy Your New Home: Take some time to settle in, make décor changes, and get familiar with your new neighborhood!

Still Overwhelmed?

Buying a home is a big step, but breaking down the process can make it feel manageable. With the right preparation, guidance, and a bit of patience, you’ll find a home that fits your lifestyle and budget. Here’s to a successful homebuying journey!